self employment tax deferral due date

The Coronavirus Aid Relief and Economic Security Act allowed self-employed individuals and household employers to defer the payment of certain Social Security taxes on their Form 1040 for tax year 2020 over the next two years. WASHINGTON The Internal Revenue Service today reminded employers and self-employed individuals that chose to defer paying part of their 2020 Social Security tax obligation that a payment is due on January 3 2022.

What The Self Employed Tax Deferral Means Taxact Blog

The tax deferral period began on March 27 2020 and ended on December 31 2020.

. Repayments of amounts deferred must be made by the end of 2021 January 3 2022 to be exact since December 31 2021 is a holiday. Under the CARES Act businesses employing W-2 workers were able to defer their share of Social Security tax. This means self-employed workers could defer 62 in Social Security tax of their taxable income 50 of their 124 Social Security tax responsibility during the deferment period.

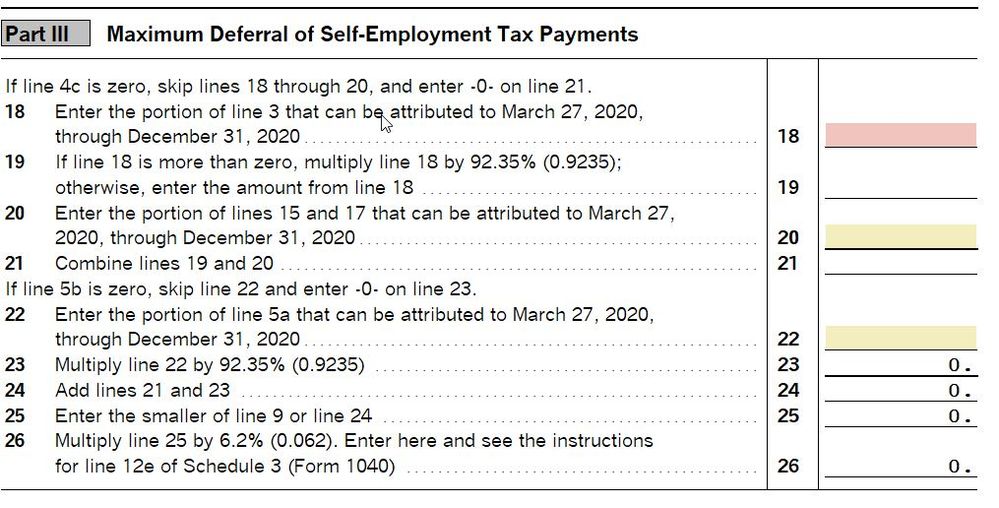

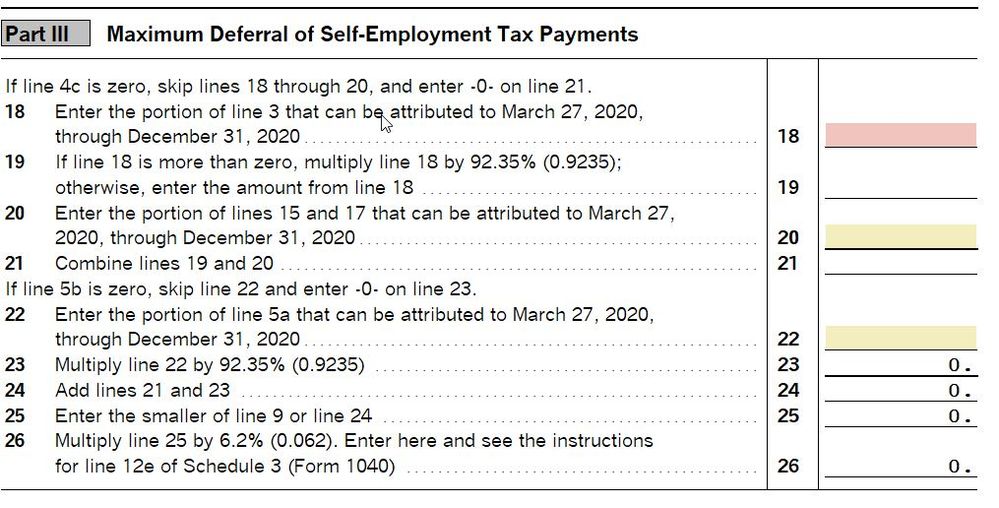

Thanks to passed legislation self-employed individuals were allowed to defer 50 of their Social Security tax portion of self-employment tax from March 27 2020 December 31 2020. The CARES Act allowed employers to defer deposit and payment of the employers portion of Social Security taxes and self-employed individuals to defer their equivalent portions of self-employment taxes otherwise due between March 27 2020 and Dec. This means that self-employed individuals that defer payment of 50 percent of Social Security tax on their net earnings from self-employment attributable to the period beginning on March 27 2020 and ending on December 31 2020 may reduce their estimated tax payments by 50 percent of the Social Security tax due for that period.

The IRS has outlined how the self-employed and household employers should repay the deferred amounts. Use the link in the other answer to make the first second payments whenever you wish up to the due dates. Self-employed taxpayers can also postpone the payment of 50 of the Social Security portion of their self-employment tax for the same period.

The Coronavirus Aid Relief and Economic Security Act allowed self-employed individuals and household employers to defer the payment of certain Social Security taxes on their Form 1040 for tax year 2020 over the next two years. Heres how to pay the deferred self-employment tax. How to report self-employment tax that was deferred in 2020 That section of the program is not fully functional right now but since you have until 12312022 to make the second 12 payment I doubt there will be a line on the tax return.

Amounts can be repaid anytime up through the due date by. Since employers and employees split the burden of Social Security tax this works out to 50 of the tax owed. April 15 May 17 for 2020 tax returns only Self-employment income taxes.

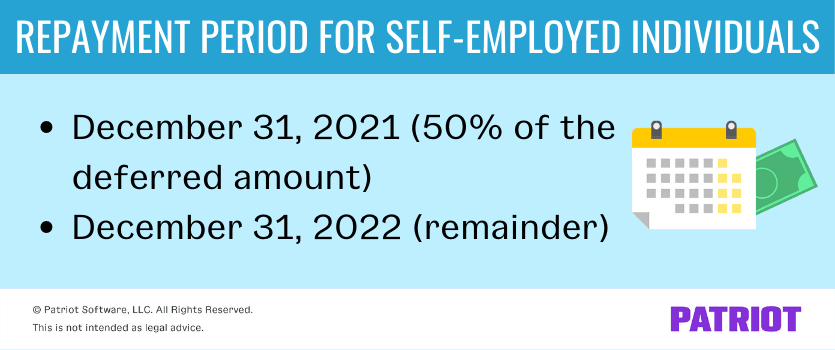

One-half of the deferred taxes must be paid no later than December 31 2021 with the remaining balance due by December 31 2022. Ad Are You Suddenly Self-Employed. Discover Helpful Information and Resources on Taxes From AARP.

If youre self-employed and you took advantage of the 2020 Social Security tax deferral the due date for your first payment is Dec. Keep Every Dollar You Deserve When You File Business Taxes w TurboTax Self-Employed. Deferred Self Employment Tax Payments not tracked.

Half of the deferred Social Security tax is due by December 31 2021 and the remainder is due by December 31 2022. Form 1040 Federal Income Tax Return Schedule C. Half of the deferred Social Security tax is due by December 31 2021 and the remainder is due by December 31 2022.

Electronic Federal Tax Payment System EFTPS. You will need to contact the IRS to see if they are applying your refund to your 2020 deferred self employment taxes. If you have income or loss from your self-employment.

Social Security tax deferral. Ad We Simplify The Process And Keep It Industry-Specific So You Can File Taxes w Confidence. Most affected employers and self-employed individuals received reminder billing notices from the IRS.

Discover Important Information About Managing Your Taxes. According to the IRS self-employed individuals may defer the payment of 50 percent of the Social Security tax imposed under section 1401a of the Internal Revenue Code on net earnings from self-employment income for the period beginning on March 27 2020 and ending December 31 2020 However the deferred payments must still be made by the dates applicable to all. If you have employees you can defer the 62 employer portion of Social Security tax for March 27 2020 through December 31 2020.

How To Defer Social Security Tax Covid 19 Bench Accounting

Irs Faqs On Deferral Of Employment Tax Deposits And Payments Tonneson Co

Guidance For Repayment Of Deferred Payroll Self Employment Taxes

Request Deferral Of Interest Payment Template By Business In A Box Statement Template Lettering Letter Of Recommendation

How To Defer Your 2020 Tax Payments Bench Accounting

Deferred Social Security Tax Payments Due Today For Employers Self Employed Njbia New Jersey Business Industry Association

Payroll Tax Deferral How Will It Affect You Experian

Pros Cons Of President Trump S Payroll Tax Deferral

Can I Still Get A Self Employment Tax Deferral Shared Economy Tax

Deferral Of Se Tax Intuit Accountants Community

Temporary Payroll Tax Deferral What You Need To Know Coastal Wealth Management

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Tax Deferral From 2020 Time To Pay Up Barbara Weltman

Self Employed Social Security Tax Deferral Repayment Info

7 Easy Payroll Remittance Form Sample Payroll Payroll Taxes Form

Deferral Credit For Certain Schedule Se Files Intuit Accountants Community

What The Self Employed Tax Deferral Means For Your Self Employed Tax Clients Taxslayer Pro S Blog For Professional Tax Preparers

Deferral Credit For Certain Schedule Se Files Intuit Accountants Community